Written by: Frank Forte

Over the past five years, commercial real estate has expanded as other real estate segments have contracted. Since 2019, the value of the commercial real estate market has grown by 12% and is expected to grow to a $28.18T market by 2028. One shining subsector is light industrial. Light industrial commercial real estate assets generally have smaller units than large industrial buildings and are often multi-tenanted. These buildings typically comprise 100,000 square feet or less and offer shorter, flexible lease terms catering to smaller businesses. Light industrial acts as a facilitator for local distribution networks, provides a solution for excess inventory, and offers versatility to accommodate a wide range of tenants and their needs, especially in service-driven capacities that follow residential development.

Historically, for many real estate investors seeking exposure to industrial real estate, large bulk distribution properties have been a popular choice for a number of reasons. First, large industrial properties generally have longer lease terms and large, stable tenants like Amazon, offering investors stability over the life of the investment. Second, the post-COVID trend of onshoring has led to the development of large distribution centers located along major transportation throughways, creating a compelling supply and demand dynamic. Third, the cookie-cutter buildouts and large transaction sizes maximize ease of capital deployment, making large bulk distribution properties an attractive investment compared to other real estate sectors.

But, with the rising interest in large bulk distribution properties, asset prices increased, too, making it challenging for investors to earn the alluring returns of early entrants to this asset class. But a burgeoning subsector is attracting investor attention—small bay light industrial. Consumers shift to same-day shipping increased the need for distribution centers located in close proximity to consumers, positioning small bay light industrial as an attractive investment.

The following factors make small bay light industrial spaces an attractive option for real estate investors: inflation protection, higher demand due to less availability, tenant diversification, and flexible lease terms. We explore each one below:

- Inflation Protection: Small bay properties with shorter lease structures and higher tenant demand offer investors protection against inflation. These assets are typically characterized by flexible, smaller spaces that attract a variety of tenants looking for short-term leases. The lease structure allows property owners to adjust rental rates more frequently, aligning rents more closely with current market conditions. The strong demand from diverse tenant types ensures steady occupancy and rental income.

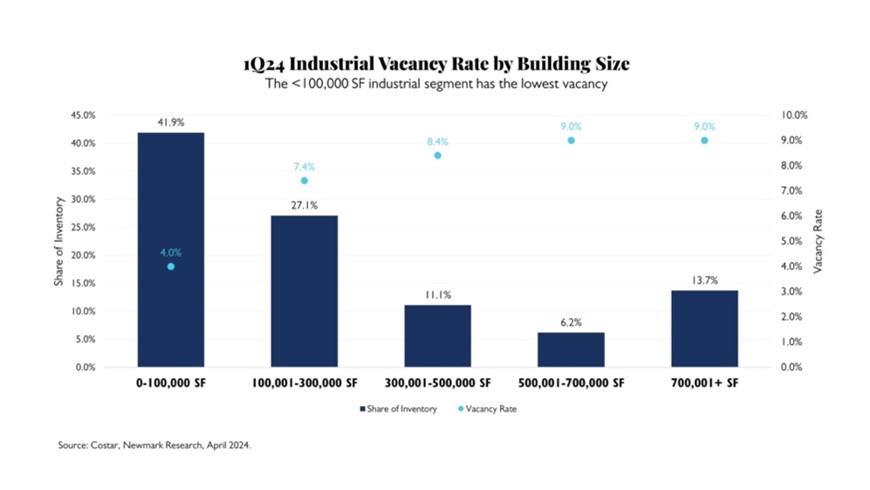

- Tenant Diversification: Small bay properties attract a diverse tenant base, including small business owners, manufacturing companies, and distribution firms. Examples include HVAC, contractors, material supply companies, mechanics, and other vendors who rent small bay industrial spaces. By having a variety of tenants from different industries, the risk associated with economic downturns in any single sector is mitigated, ensuring more consistent cash flow. Diversification reduces vacancy impact and maintains steady rental income, with strong demand from diverse tenants supporting steady occupancy and income. The diversification of tenants in small bay light industrial creates factors that should yield a higher property valuation over the life of the asset. With the dynamic needs of the diverse tenant base driving demand, the flexibility that small bay light industrial offers in space configuration becomes paramount. According to Newmark’s 1Q24 Industrial Trends report, because of these tenant diversification dynamics, small-bay product has historically traded 50 to 100 bps higher than bulk distribution product. Serving as a testament to its investor appeal.

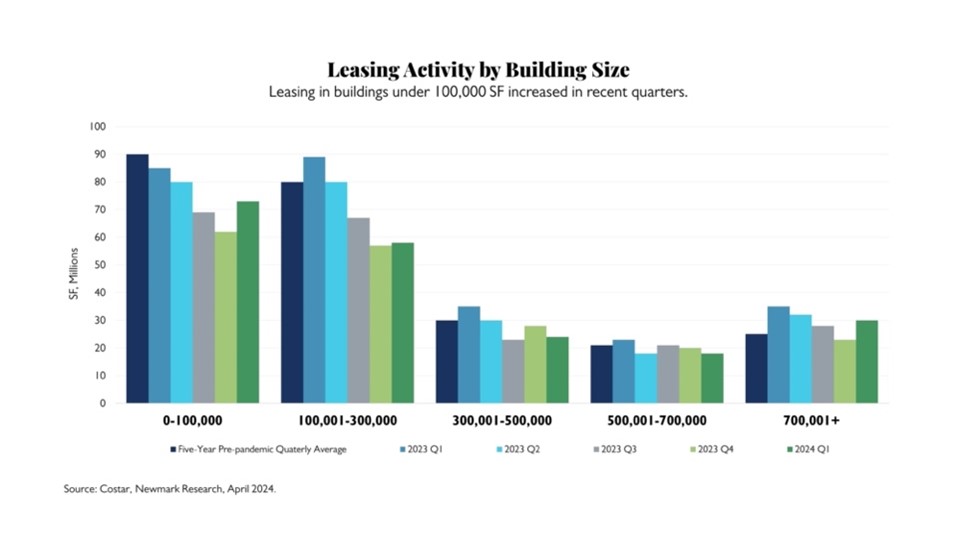

- Supply Constraints: Urban zoning restrictions, limited available land, and high construction costs are impeding the development of new small bay facilities. Almost half of all new industrial space under way is in the larger warehouse segment, while just 4 percent of space under way falls in the small-bay segment according to CoStar. Consequently, existing properties are becoming increasingly valuable with rising rental rates and property prices. For investors, this shift is prompting them to seek older properties that they can modernize and purchase for a more attractive cost. For businesses, the limited availability is leading to higher operational costs and competition for space which eventually may drive some to seek alternative locations. Overall, the lasting supply constraints are reshaping the industry, fostering a highly competitive market and elevating the investment appeal of these properties.

- Differentiated Lease Terms: Lower weighted average lease terms in the small bay market allow property owners to frequently adjust rental rates in response to overall market conditions, making these properties more adaptable and resilient to economic fluctuations and inflation. This flexibility attracts investors seeking to capitalize on periodic rent increases and mitigate long-term risk. There is risk with this strategy, namely tenant turnover, which can lead to higher management costs and periods of vacancy. For tenants, shorter leases offer greater flexibility but also create uncertainty around future rental costs and long-term occupancy stability. Small bay light industrial has the advantages of short-term, triple net leases, compared to other industrial asset types as well. On average, small bay light industrial has shorter weighted average lease time of one to three years compared to five to 10 years for larger industrial spaces according to CoStar.

Small bay light industrial properties are a promising commercial real estate sector subsegment, offering advantages that cater to evolving market dynamics. The sustained demand for small bay light industrial assets is expected to persist as companies and logistics operators expand their networks to enhance proximity to consumers. The unique supply and demand dynamic, coupled with consumer demand for immediate delivery of goods, has positioned this market subsegment attractively. The momentum for small bay light industrial is sustained by favorable economic conditions, the need for supply chain efficiency, population migration, the trend toward onshoring, and technology innovation in the United States. As the commercial real estate sector continues to evolve, small bay spaces may indeed be one of the sector’s best kept secrets.

Frank Forte is the Founder and CIO of Lucern Capital Partners, an investor in industrial, multi-family, and mixed-use assets in the Sunbelt, with a focus on the Carolinas. Lucern applies a value-oriented philosophy to investing, maintaining an institutional approach, a yield-focused strategy, deep market knowledge, and active asset management. Visit Lucern Capital Partners’ website to learn more: lucerncapital.com.